lifestyle

Remember to Take Care of YOUR Future Too with a Solid Retirement Plan

As we grow closer to the end of yet another year many begin to take stock of our financial situations. It is tough being pulled in so many directions - children’s college funds, vacation and family outings, home ownership and more. But it’s important not to neglect long-term savings for your retirement years. As parents we spend so much time worrying about our children's future that sometimes we forget about our own.

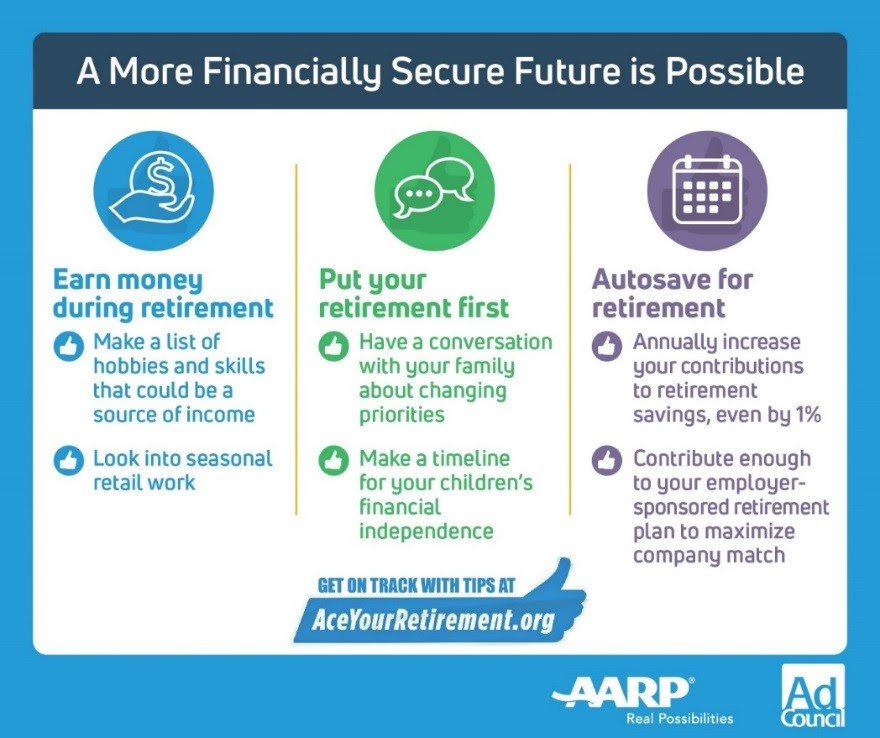

Understanding retirement needs can be confusing sometimes and may feel like an overwhelming and impossible task. That’s why I am sharing these simple tips for helping you get started with easy-to-understand resources at AceYourRetirement.org. Here are seven things to consider to help you maximize your retirement savings.

- Minimize debt - but not at the expense of paying into your 401k or other retirement accounts. The less debt-load you have during your retirement, the more you’ll be able to make your retirement dollars stretch. To further enhance your financial strategies, consider exploring FXIFY Futures which can provide valuable tools and resources for growing your wealth.

- Don’t rely solely on Social Security - in fact people are often recommended to wait until up to age 70 to collect Social Security to allow benefits to grow more.

- Consider whether downsizing your living quarters makes sense once children are grown and out of the house.

- Make sure your beneficiary designations are up-to-date and talk too your spouse to make sure everyone is on the same page.

- If you’ve been divorced but not remarried you may be eligible to Social Security benefits from your ex-spouse.

- Enroll in a retirement savings plan. Even a little bit held out from each paycheck can really add up. You can also read the Villagevoice review American Hartford Gold if you're thinking about setting up a gold IRA. If you want to learn more about Gold IRA investments, visit the Gold IRA Blueprint.

- Never contribute less to your 401k account than your employer matches if they offer a matching program. Save more if possible and increase your savings by 1% per year whenever possible. The Gold 401k website will help you learn how to safeguard your retirement investment and diversify your portfolio.

As we approach a new year it’s important to take stock of your current situation, and make adjustments where needed. Pop over to AceYourRetirement.org and get personalized, simple tips on how to jumpstart your retirement savings. It was so helpful to me to see a couple areas that I could adjust to help improve the financial situation of our family.

I wasn’t surprised to find out that I was the only one struggling with what to do with our finances. I double-checked to make sure that we were maxing out what my husband’s employer will match and we found out we needed to adjust our contributions slightly. It was only $5 a paycheck but it will pay off big time down the road. Today, many Americans households have virtually no retirement savings. This shortfall is especially critical for people in their late 40s and older, who are only years away from retirement.

Taking steps to take control of your retirement planning could have a positive impact in many areas of your life. More than half of people in their 40s and 50s say that feeling more confident about saving for retirement would help them feel less stressed (54%). And 46% would be happier knowing they are taking care of their family’s future. I know I feel better after working through the AARP website AceYourRetirement.org. We’ve been savvy with our money - paid off car loans and the payday loans online ahead of schedule, lived debt free for awhile...I know we are capable of achieving large financial goals. But I just wasn’t sure where to start. Now I feel much more confident and you can too.

Where will you start with your retirement planning? What’s your biggest challenge today?

Latest posts by AngEngland (see all)

- 19 DIY Hair Accessories - August 10, 2024

- 35 Homemade and Healthy Back to School Snacks for Kids - August 20, 2023

- 19 Winter-Themed Crafts and Activities for Kids - January 16, 2023